Medicare Advantage plans don’t typically have a large population of members with End-Stage Renal Disease (ESRD). In our work with dozens of plans, we see about 5% of members with ESRD, a condition where there is permanent and almost complete loss of kidney function.

These few members, however, can have a big impact on a plan’s financial health if the Centers for Medicare and Medicaid (CMS) are underpaying premiums for these members. And especially if CMS has been underpaying for a length of time.

The average cost to treat a patient with ESRD can run well over $60,000 a year because members may require dialysis several times a week. To offset this higher cost of care, CMS typically pays health plans a premium of $7,100 for managing members with ESRD, compared to a premium of $815 for non-ESRD members. When you multiply the gap between non-ESRD premiums and ESRD premiums year over year, having the wrong ESRD status for a member can be quite costly to your plan.

Ongoing inaccuracies can mean that your plan is losing out on millions of dollars

Determining the cause of the error is time-consuming—and can be complicated—for health plans.

When you multiply the gap between non-ESRD premiums and ESRD premiums year over year, having the wrong status for your ESRD members can cost your plan millions.

Let’s take a look at how the ESRD process ideally works:

- The ESRD patient visits a dialysis clinic for treatment.

- The dialysis clinic or submitting authority fills out form 2728 (completely and accurately) and submits this to CMS through CROWNWeb, the data-management system that allows Medicare-certified dialysis facilities to safely submit facility and patient data to CMS.

- CMS is alerted to the patient’s ESRD status—and an ESRD indicator flag is turned on that will adjust the premium for that patient.

- Your plan then receives a higher premium for covering these patients.

In some situations, however, the process breaks down:

- Members have ESRD diagnoses that your plan never knew about

- The dialysis clinic or provider doesn’t complete the 2728 form or sends incomplete or incorrect forms

- The clinic saves the form in CROWNWeb but doesn’t hit “submit”

- Flag are temporarily turned off and not turned back on—for example, because the member went to hospice for a period of time

- CMS fails to set the flag or had inaccurate dialysis start dates

MultiPlan is adept at navigating these complex processes and restoring premiums

MultiPlan can help your plan identify members with missing ESRD statuses and work to correct the errors at the source—by working directly with the submitting provider and CMS.

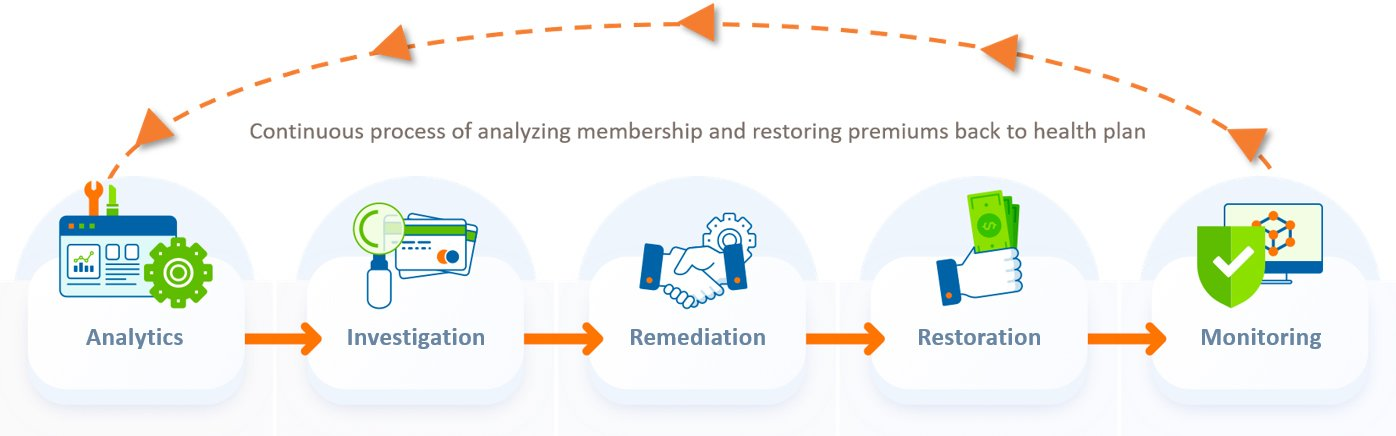

To begin our restoration process, we use the plan’s historical claims data and multiple data sources to identify claims diagnosis patterns. We look at the detailed membership files to see if that ESRD flag is present. If it’s not, we reach out directly to the dialysis center and, if needed, get the 2728 form resubmitted properly.

This can sometimes prove challenging as the dialysis center’s main focus is on patient care and not necessarily on ensuring the 2728 form has been completed accurately and submitted through CROWNWeb appropriately. So, our team will explain the importance of following CMS guidelines and will work with the dialysis center from start to finish to ensure the form is accurately re-submitted through CROWNWeb. We also coordinate with CMS to make sure that flag gets turned for the appropriate timeframe. Finally, we track the CMS Monthly Membership Report (MMR) updates and continuously monitor MMRs to ensure the flags remain on, as necessary.

Let us start reviewing your records

MultiPlan can help find value for any size health plan, utilizing an 84-month non-intrusive lookback that restores actual premium dollars based on corrected ESRD flags. Plus, based on corrected ESRD flags, our lookback work ensures that future premiums are paid accurately for members with ESRD.

Learn more about how MultiPlan’s Revenue Integrity Services can help you restore and protect your premium dollars, potentially adding millions to your bottom line.

Previously published on the former Discovery Health Partners website.