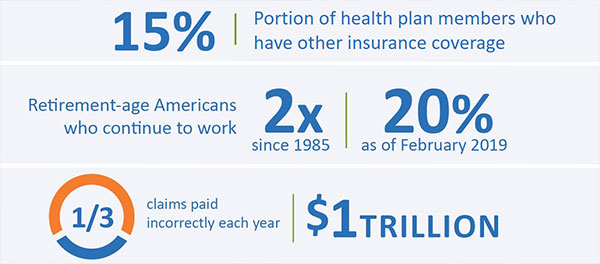

As many as 15% of your health plan members have other insurance coverage, creating a multi-million dollar impact on your health plan’s time, resources, and, ultimately, bottom line. In instances of overlapping coverage, health plans shoulder the burden of accurate claim payments. The arduous process of identifying other insurance, validating coverage status, and recovering incorrectly paid claims all generate substantial administrative costs and greatly affect provider and member relationships.

There are several trends that contribute to the issue of incorrectly coordinated claims. First are continual changes in membership. Take, for example, the nation’s aging population. Increasing numbers of baby boomers are reaching age 65 and becoming eligible for Medicare. At the same time, the percentage of retirement-age Americans who continue to work has doubled since 1985, surpassing the 20% mark in February 2019. Many of these older workers are covered by both their employers’ plans and by Medicare. In addition, health plans’ current claims processing environments entail highly manual, error-prone methods for verifying eligibility and insurance information. As many as a third of claims are paid incorrectly each year, contributing to approximately $1 trillion in annual waste.

These trends create a need for a new, modern approach to coordination of benefits (COB). In today’s competitive marketplace, the old tried and true approach to coordination of benefits—sending lots of member surveys (that cause member abrasion) and doing routine data mining (which produces lots of false positives)—isn’t enough anymore.

Bringing COB into the 21st century, MultiPlan blends the right people, processes, and technology to allow our team and our clients to work smarter rather than harder, effectively integrates data sources, looks at member eligibility holistically, and determines the most successful indicators or combination of indicators of other coverage.

AI, meet HI

Our “modern” approach to COB” does not mean that we’ve completely automated the process. To the contrary, MultiPlan believes that machines (AI) are only part of the coordination of benefits equation. It is the human intelligence (HI) component of our coordination of benefits solution that makes it very effective—and really special. AI, meet HI.

Sure, MultiPlan has built custom technology that is really awesome and supports intelligent coordination of benefits workflow and accurate findings. But it is the human factor that is MultiPlan secret sauce—the irreplaceable factor that brings things like critical thinking and an awareness of member sensitivity to the equation. It is this nexus of cutting-edge technology and amazing people that modernizes our approach to COB.

The human component of our Coordination of Benefits solution is comprised of subject matter experts with extensive experience working directly for both payers and providers. This combination creates a unique perspective in not only how to identify COB value for health plans, but also how to implement and operationalize a process that will be the least intrusive for the provider community. Everyone, including our COB leadership, has actually been in the payment integrity space on the front lines (as analysts) at one time or another. We know what it takes to bring maximum value.

Intelligent platform + data sources + matching capabilities

We pair our Coordination of Benefits (COB) human intelligence with an intelligent, custom-built platform that supports the entire COB lifecycle. Going way beyond routine data matching, our process includes intelligent matching, workflow management, and machine learning algorithms.

MultiPlan uses many data sources in our algorithms. There are thousands of data sources available—some of which present a high return, while others provide minimal value. Based on our experience, MultiPlan focuses on the more intelligent sources that historically have a high yield. Our program consists of both traditional data and nontraditional data sources, and we’re continually evaluating new sources with high potential.

MultiPlan uses several matching processes to ensure the most comprehensive and accurate results possible. We supplement the demographic matching points (e.g., member name, member date of birth) by identifying and updating missing or incorrect information that is preventing a correct match. For example, our process seeks to verify inconsistent address information (“123 South West Main Street” vs. “One Two Three SW Main St.”), name normalization, and partial matches when most but not all key elements match. Additionally, we review case explosion opportunities such as when a member lives in the same household as dependent-aged children.

A modern, intelligent blend for coordination of benefits success

MultiPlan blends our rock-star COB human intelligence with advanced technology capabilities to deliver great results for our clients. It’s a modern COB solution that we’re proud to bring to health plans across the country now and into the future.

Learn more about how MultiPlan’s Revenue Integrity Services can help you restore and protect your premium dollars, potentially adding millions to your bottom line.

Previously published on the former Discovery Health Partners website.